Taking control of your personal finance can be a huge challenge.

The first step is locking down a manageable budget, but forget complicated Excel spreadsheets.

The best way to help organise a budget – and keep it – is using one of these money management apps.

What is a budget app?

A budget app for your iPhone or mobile is a great way to keep track of your finances.

It is a personal finance tool you can keep in your back pocket.

A good budgeting app will sort your financial obligations efficiently and help you mange debt, save for that wedding/trip/car and help you to keep a record of your spending patterns.

What are the best budget apps in Australia?

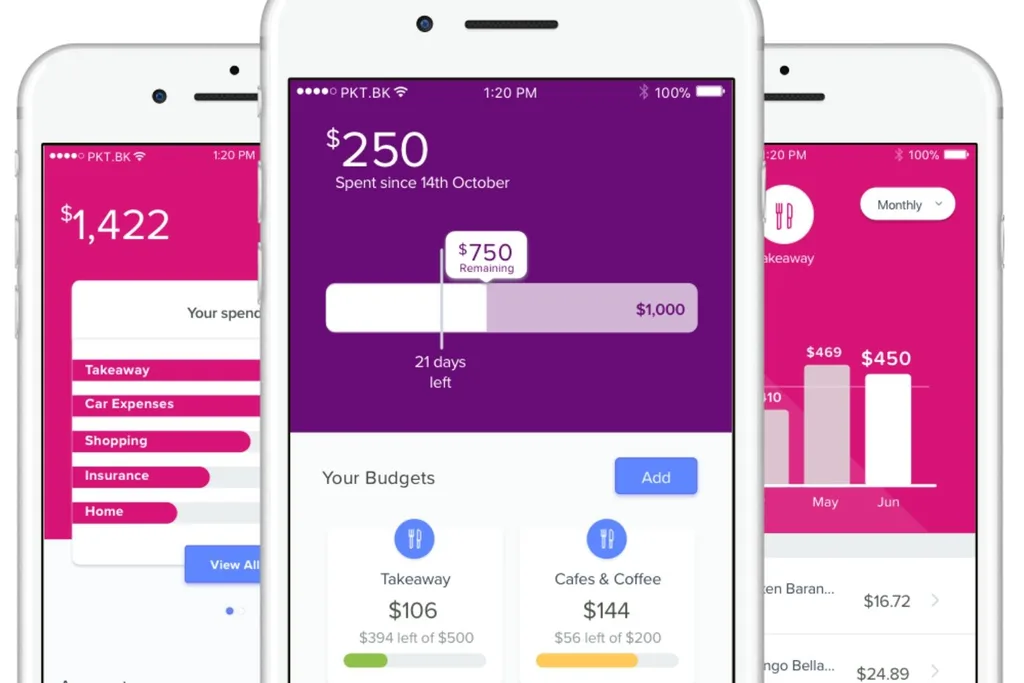

Pocketbook

Pocketbook is a free budgeting tool which is a great, simple way to organise your personal finance.

This app actually syncs to your bank account to track your spending habits and gives a complete breakdown of where your money goes.

It is compatible with most of the big Australian banks, such as Commonwealth Bank, ANZ and Westpac.

Pocketbook describes itself as a ‘personal assistant’ for your money.

By categorising your purchases, you can get a clear understanding of where you spend your money and the best ways to curb unnecessary costs.

Available on: Apple App Store and Google Play stores

2. Raiz

Raiz is a spare change app for amateur investors wanting to save as much money as they can.

This app automatically rounds up money – with no minimum amount – and invests it for you in the share market.

Raiz charges a monthly fee of $1.25 for accounts with a balance of under $5,000 and 0.275% annually for accounts with a balance of $5,000 and over.\

Available on: Apple App Store and Google Play store.

3. MoneyBrilliant

MoneyBrilliant is another money management tool which acts like a pocket personal finance assistant.

This app connects all your bank accounts in the one device and helps you manage your expenses and savings, keep track of bills and will categorise your purchases to give a clear picture of your financial position and money habits.

MoneyBrilliant also allows you to set savings goals and tracks your progress.

Available on: Apple App Store and Google Play store.

4. Spendee

This budgeting app is a free tool that again automatically syncs with your bank or financial institution, categorising your transactions and giving you a complete overview of your finances.

You can also manually add expenses and track where all your money goes in a simple and fast method which is much easier than an excel spreadsheet.

The more you use Spendee, the better you can keep track of your spending habits. As it analyses your financial data, it develops charts that show you your income vs. outgoing funds.

With Spendee, you can also invite other friends or family members to manage a ‘shared budget’.

Available on: Apple App Store and Google Play store.

5. Wildcard

This app is a different kind of budgeting tool. Wildcard drip feeds your salary (or nominated amount of money) into your Wildcard ‘bank card’, forcing to to adhere to a maximum amount of spending each day.

It’s the best way to spread out your pay cheque and to stay dedicated to a tight budget, helping you achieve your saving goal.

Link up Wildcard with Apple Pay to get started – and they will send you your own Wildcard Mastercard.

Available on: Apple App Store and Google Play Store.

6. Moneytree

Savings app Moneytree brings together everything from your bank accounts – your assets, debts, superannuations and digital money – to give the most complete picture of your financial position.

You can log your cash transactions while also syncing the app with your bank or financial institutions to keep track of your bank transactions.

Moneytree also has a notification service which reminds you of upcoming bills and low balances.

Available on: Apple App Store and Google Play Store.

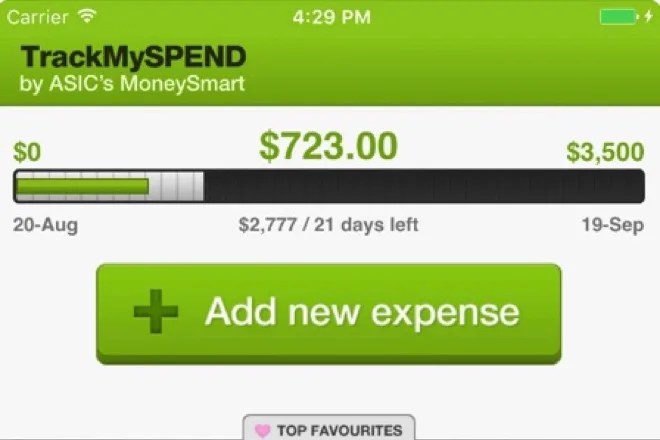

7. TrackMySpend

This money management tool which was developed by the ASIC (Australian Securities and Investments Commission) is an easy-to-use app for tracking your budget.

It is a simplified expense tracking app which is perfect for someone who is just starting out on their budget plan or for someone who is keen to get their budget back on track.

The app allows you to set your spending cycle and spending limit and you can manually add in expenses as you spend.

Available on: Apple App Store and Google Play stores